Jonathan Schell’s remembrance of former Defense Secretary Robert Strange McNamara begins with the story of Schell’s meeting with McNamara in 1967, at which he, then a young reporter for The New Yorker, briefed the secretary on what he had seen American forces doing in Vietnam. Schell would not hear from McNamara after that meeting, but declassified documents would subsequently reveal that the secretary had responded to it by attempting to discredit Schell’s story and block its publication. Schell mentions McNamara’s subsequent contrition for his Vietnam policies, stressing that the remorse he suffered was quite trivial compared with the what the people of Vietnam suffered during the war McNamara did so much to design. Still, Schell points out, McNamara was unique among high-level US policymakers of recent decades in publicly admitting error. The piece ends with Schell’s line “If there is a statue made of McNamara, as there probably will not be, let it show him weeping. It was the best of him.”

Jonathan Schell’s remembrance of former Defense Secretary Robert Strange McNamara begins with the story of Schell’s meeting with McNamara in 1967, at which he, then a young reporter for The New Yorker, briefed the secretary on what he had seen American forces doing in Vietnam. Schell would not hear from McNamara after that meeting, but declassified documents would subsequently reveal that the secretary had responded to it by attempting to discredit Schell’s story and block its publication. Schell mentions McNamara’s subsequent contrition for his Vietnam policies, stressing that the remorse he suffered was quite trivial compared with the what the people of Vietnam suffered during the war McNamara did so much to design. Still, Schell points out, McNamara was unique among high-level US policymakers of recent decades in publicly admitting error. The piece ends with Schell’s line “If there is a statue made of McNamara, as there probably will not be, let it show him weeping. It was the best of him.”

McNamara features in another piece on The Nation‘s website as well, an article by Robert Scheer extracted from Truthdig. Scheer denounces McNamara’s Vietnam record far more bitterly than Schell does. And Nation columnist Alexander Cockburn pointed out in his newsletter Counterpunch that McNamara’s record as president of the World Bank, often presented as humanitarianism that redeemed him after his time at the Pentagon, was in fact nothing of the sort. Relying on Bruce Rich’s 1994 history of the World Bank, Mortgaging the Earth, Cockburn lists one dictatorship after another that McNamara’s World Bank lavished with funds as it committed unspeakable atrocities. Cockburn might easily have added substantially to the tally of carnage the World Bank wrought in those years. In 2005, his newsletter argued that it was largely due to World Bank lending policies that the 26 December 2005 Indian Ocean tsunami was so deadly. It may even be possible that McNamara was responsible for more deaths through his activities at the World Bank than through those at the Pentagon.

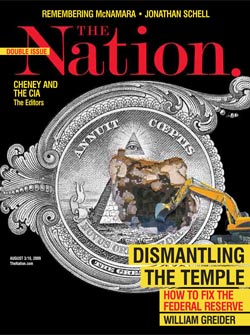

It’s a bit odd that this issue doesn’t make more of McNamara’s time at the World Bank, since it devotes a great deal of space to another public-sector financial institution, the US Federal Reserve. William Greider calls for reform of the Federal Reserve, warning that the Obama administration’s plans to increase the already vast powers of this body without reform involves the USA in several dangers. Among these: “It would reward failure”; it would encourage the Fed to print money with which to paper over the unsoundness of financial deals it helped to complete in recent years; “The Fed can’t be trusted to defend the public in its private dealmaking with bank executives”; “Instead of disowning the notorious policy of “too big to fail,” the Fed will be bound to embrace the doctrine more explicitly as “systemic risk” regulator”; and, as if that weren’t enough, “This road leads to the corporate state—a fusion of private and public power, a privileged club that dominates everything else from the top down.” Considering that “the corporate state” was a 1930s-era synonym for fascism, you can see that Greider is pretty serious about his opposition to the Obama plan.

As an alternative, Greider proposes “democratizing the Fed,” subjecting it to the same requirements of transparency and accountability that other government agencies must meet. Under his proposal:

A reconstituted central bank might keep the famous name and presidentially appointed governors, confirmed by Congress, but it would forfeit the mystique and submit to the usual stand ards of transparency and public scrutiny. The institution would be directed to concentrate on the Fed’s one great purpose—making monetary policy and controlling credit expansion to produce balanced economic growth and stable money. Most regulatory functions would be located elsewhere, in a new enforcement agency that would oversee regulated commercial banks as well as the “shadow banking” of hedge funds, private equity firms and others.

The Fed would thus be relieved of its conflicted objectives. Bank examiners would be free of the insider pressures that inevitably emanate from the Fed’s cozy relations with major banks. All of the private-public ambiguities concocted in 1913 would be swept away, including bank ownership of the twelve Federal Reserve banks, which could be reorganized as branch offices with a focus on regional economies.

Such reform may sound radical to some, but would in fact represent a return to Constitutional norms:

Altering the central bank would also give Congress an opening to reclaim its primacy in this most important matter. That sounds farfetched to modern sensibilities, and traditionalists will scream that it is a recipe for inflationary disaster. But this is what the Constitution prescribes: “The Congress shall have the power to coin money [and] regulate the value thereof.” It does not grant the president or the treasury secretary this power. Nor does it envision a secretive central bank that interacts murkily with the executive branch.

The prevailing political culture of Washington may be keep us from being optimistic that this plan will be adopted, but Greider claims we needn’t be overly pessimistic:

Given Congress’s weakened condition and its weak grasp of the complexities of monetary policy, these changes cannot take place overnight. But the gradual realignment of power can start with Congress and an internal reorganization aimed at building its expertise and educating members on how to develop a critical perspective. Congress has already created models for how to do this. The Congressional Budget Office is a respected authority on fiscal policy, reliably nonpartisan. The Congress needs to create something similar for monetary policy.

Instead of consigning monetary policy to backwater subcommittees, each chamber should create a major new committee to supervise money and credit, limited in size to members willing to concentrate on becoming responsible stewards for the long run. The monetary committees, working in tandem with the Fed’s board of governors, would occasionally recommend (and some times command) new policy directions at the federal agency and also review its spending.

Jeff Faux’s “So Far from God, So Close to Wall Street” argues that the trade policies enshrined in the North American Free Trade Agreement have hurt working people in Mexico. He quotes a Mexican businessman who told him that while NAFTA was advertised as a way of narrowing the wage gap between the US and Mexico, it has in fact narrowed the wage gap between Mexico and China.

No comments:

Post a Comment